Business Appliance Cost Calculator

Appliance Details

Ownership Options

Results

When you hear the word appliance meaning in a boardroom, it’s easy to picture a kitchen mixer or a dryer. In the business world, however, “appliance” stretches far beyond home gadgets. It’s a shorthand for any piece of equipment, asset, or service that a company uses to keep operations humming, cut costs, or boost productivity. Below we break down what “appliance” really means for businesses, why the term matters, and how you can make smarter decisions around it.

Defining "Appliance" in a Business Context

Appliance is a tangible item or service that supports core business functions, ranging from production machinery to IT services and even facilities upkeep. Companies treat appliances as operational tools rather than mere consumer goods. The definition is intentionally broad because every industry has its own set of critical tools. In a restaurant, a commercial oven is an appliance; in a data center, a cooling unit or server rack qualifies; in a retail store, point‑of‑sale terminals are appliances.

How Appliances Differ from Equipment and Assets

Business jargon loves to cluster similar concepts together, but there are subtle distinctions worth knowing. Below is a quick side‑by‑side view that clears up the confusion.

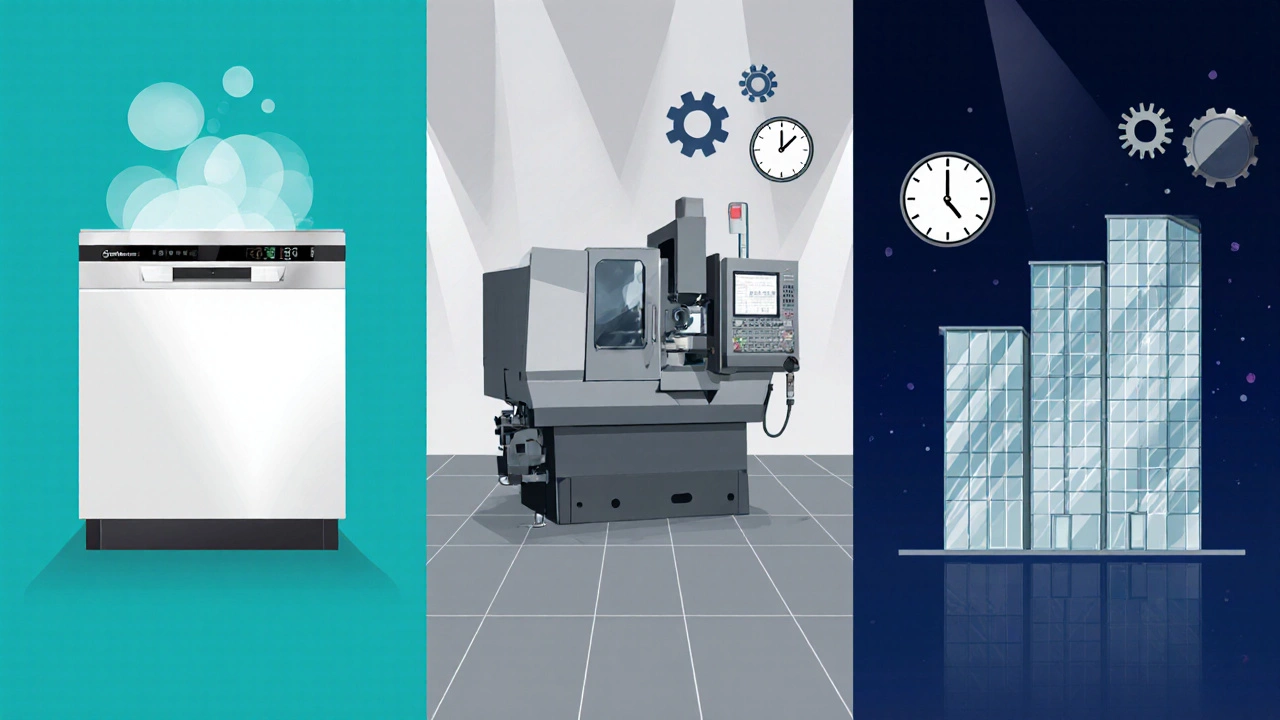

| Aspect | Appliance | Equipment | Asset |

|---|---|---|---|

| Primary Focus | Supports day‑to‑day operations | Specialized tools for production or service delivery | Long‑term financial value on the balance sheet |

| Typical Lifespan | 3‑7 years | 5‑15 years | 10‑30+ years |

| Accounting Treatment | Expensed or depreciated as a low‑cost item | Depreciated over useful life | Capitalized and depreciated |

| Examples | Commercial dishwasher, HVAC unit, SaaS subscription | Laser cutter, CNC machine, forklift | Real estate, patents, large‑scale production line |

Notice how appliances often sit at the intersection of equipment and services. A washing‑machine for a hotel laundry is both a piece of equipment and a service‑based appliance when you lease it with maintenance included.

Why the Term Matters for Decision‑Makers

Understanding the nuance helps finance, operations, and procurement teams speak the same language. When a CFO asks for “appliance spend,” they usually want to see costs that can be optimized quickly-things that don’t tie up capital for decades but still affect cash flow.

- Capital Expenditure (CapEx) versus Operating Expenditure (OpEx) decisions become clearer when you categorize items correctly.

- Maintenance contracts, warranties, and service-level agreements (SLAs) are often bundled with appliances, affecting total cost of ownership.

- Performance metrics like Return on Investment (ROI) can be calculated faster for appliances because their financial impact shows up in the profit‑and‑loss statement sooner.

In short, calling something an appliance signals that it’s a relatively low‑commitment, high‑impact tool you can swap or upgrade without a massive financial hit.

Common Business Appliances and Their Uses

Below is a non‑exhaustive list of appliances you’ll encounter across industries, along with typical use cases and how they affect the bottom line.

- HVAC Systems: Keep workplaces comfortable, regulate temperature for sensitive equipment, and often come with energy‑efficiency service contracts.

- Commercial Kitchen Equipment: Ovens, fryers, and dishwashers that enable food‑service businesses to meet health standards and speed up service.

- IT Infrastructure: Servers, networking gear, and cloud‑based software that power daily operations; many are leased as appliances with support.

- Printing & Copiers: Essential for offices; maintenance plans turn these into serviced appliances rather than capital purchases.

- Cleaning Machines: Floor scrubbers and extraction units reduce labor costs and improve workplace hygiene.

- Medical Devices: Imaging equipment or sterilizers that are often rented with full‑service agreements, classifying them as appliances for hospitals.

Each of these items can be bought outright, leased, or purchased as a managed service. The choice influences cash flow, risk, and how you count the expense on financial statements.

Evaluating Appliance Options: A Simple Checklist

Before you sign a contract or place an order, walk through this quick checklist. It saves time and prevents surprise costs down the road.

- Life‑Cycle Cost: Add purchase price, installation, maintenance, energy use, and disposal fees.

- Warranty & Service: Does the vendor offer a comprehensive SLA? What’s covered, and for how long?

- Energy Efficiency: Look for certifications (e.g., ENERGY STAR) that reduce utility bills.

- Scalability: Can you upgrade the appliance without ripping out infrastructure?

- Compliance: Ensure the appliance meets industry regulations-food safety, health standards, data security, etc.

Answering these questions forces you to treat the appliance as a strategic asset rather than a one‑off purchase.

Maintenance and Service Models for Business Appliances

Most businesses opt for a service model because it turns a capital hit into a predictable monthly fee. Here are three common arrangements:

- Full‑Service Lease: Vendor supplies, installs, and maintains the appliance. You pay an all‑inclusive fee, often with an option to buy at the end.

- Extended Warranty: You own the appliance but pay extra for parts and labor coverage beyond the standard warranty.

- Pay‑Per‑Use: Common for cloud‑based software and some industrial equipment. You only pay for actual usage, making budgeting flexible.

When the service model aligns with your cash‑flow strategy, you transform a potential expense into an operational advantage.

Real‑World Example: A Small Café’s Appliance Strategy

Imagine a café in Wellington that needs a commercial espresso machine, a dishwasher, and an HVAC unit. Here’s how a savvy owner might handle each:

- Espresso Machine - Purchased outright (CapEx) because the brand holds high resale value and the café wants control over cleaning schedules.

- Dishwasher - Leased with a full‑service agreement (OpEx). The lease includes quarterly maintenance, ensuring the machine stays hygienic without surprise repair bills.

- HVAC Unit - Opted for a pay‑per‑use energy‑efficiency model offered by a local provider. The café only pays for the cooling it actually consumes during busy summer months.

By mixing purchase, lease, and pay‑per‑use, the café keeps its cash‑flow steady, minimizes downtime, and can upgrade appliances as technology improves.

Key Takeaways for Business Leaders

- In business, "appliance" means any tool, equipment, or service that keeps daily operations running.

- Distinguish appliances from broader assets to make smarter budgeting choices.

- Use the checklist to evaluate total cost, warranty, efficiency, and compliance before buying or leasing.

- Consider service models-full‑service lease, extended warranty, or pay‑per‑use-to align expenses with cash‑flow goals.

- Regular maintenance isn’t a cost; it’s an investment that protects productivity and reduces unexpected downtime.

Understanding the true meaning of "appliance" helps you treat these essential tools as strategic levers, not just line‑item purchases.

What qualifies as a business appliance?

A business appliance is any equipment, device, or serviced product that directly supports daily operations. Examples include commercial ovens, HVAC systems, point‑of‑sale terminals, and cloud‑based software that is delivered with maintenance support.

How does an appliance differ from capital equipment?

Appliances are typically lower‑cost, shorter‑life items that can be expensed or depreciated quickly, whereas capital equipment is a long‑term asset with a higher purchase price and longer depreciation schedule.

When should I lease an appliance instead of buying?

Leasing makes sense when you want predictable monthly costs, need regular maintenance, or plan to upgrade frequently. It’s especially handy for fast‑changing tech or equipment that requires specialist service.

What are the hidden costs of appliance ownership?

Hidden costs include energy consumption, routine maintenance, downtime during repairs, and disposal fees at end‑of‑life. Ignoring these can turn a seemingly cheap purchase into a costly liability.

Can I treat appliance expenses as tax‑deductible?

Yes, most appliance costs qualify as operating expenses and can be deducted in the year incurred, provided they don’t exceed the threshold for capitalisation under local tax law. Always check with a tax professional for your jurisdiction.